KCA News & Media

Press Release

Press Release

| Mobile Easy Payment Service Needs More Affiliated Shops and Additional Services | |||||

|---|---|---|---|---|---|

| Date | 2016-09-22 | Hit | 2731 | ||

|

Mobile Easy Payment Service Needs More Affiliated Shops and Additional Services

The recent Fintech boom is boosting the development of new financial services with new information technologies. Indeed, mobile payment system is showing a rapid growth, forging a KRW 5.72 trillion market volume as of 2Q in 2015.

At present, there are more than 30 sorts of Mobile Easy Payment Services available in Korea, all of which have different features. Yet, consumers have difficulties in choosing which service they would like to use due to lack of comparable information.

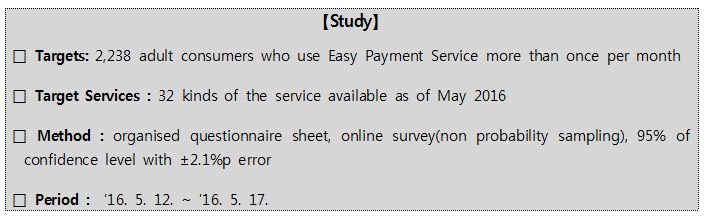

Korea Consumer Agency (www.kca.go.kr) conducted a study as to what kind of mobil payment services are available and how much consumers are using them, in order to provide consumers relevant information and address issues that cause inconvenience.

□ Credit card companies, distributors online platform providers, PG, and other businesses develop Mobile Easy Payment Services Easy Payment Services have two providers; one is credit card businesses, financial institutions, which have created ‘app card’ on mobile devices to facilitate the use of credit card via the application. The other is non-financial businesses including distributors, franchise coffee shops, online platform providers, and PG. They offer payment services with different features yet the uses are limited to certain areas.

Most of the services can be used both online and offline, but there are also those only available online or offline: Tmon Pay, Kakao Pay, Smile Pay, and PAYALL are for online use and T Pay, Paynow Touch are for offline use. The services by credit card firms, such as AppCard and Samsung Pay, are available to be used in most of the stores. Meanwhile, the cards created by distributors, open markets, social commerce, and coffee franchises can only be used at affiliated stores or online.

Consumers, however, have experienced inconvenience to use the easy payment system offline, because they have to go through four to five phases of verification process of the service. The users also have to show applications on devices for discount or point reserve before they pay with the service app, which might bother them. * Easy Payment Services with automatic price discount and point reserve: Syrup Pay, UBpay, H Wallet, L Pay, SSG Pay, T Pay, etc.

Furthermore, most of the services utilise only password for payment verification, which has risk of password leaking. The service providers do not tell consumers how many affiliated stores allow to use their services, causing another inconvenience. * The payment services that provide options for verifying payment: Naver Pay (password or fingerprint), Paynow (password, graphics, fingerprint, or pattern drawing), Samsung Appcard (password or fingerprint), Shinhan Appcard,(password or fingerprint), K Pay(password, fingerprint, or graphics), etc.

□ The number of Easy Payment Services used per capita is 5.1 on average, mostly used for online shopping (71.9%)

A study was conducted for discovering how much the service users utilize the system, and the result showed 65.8% of the respondents use more than once a week. Those who use the service once a week makes up the biggest share, 22.4% (501 respondents), followed by ‘ones in two or three days’ users (20.7%, 462 respondents), ‘once in four or five days’ users (13.5%, 302 respondents), and ‘mostly everyday’ users (9.2%, 206 respondents). * The top 10 most frequently used services are: KB Appcard, Naver Pay, Samsung Pay, Starbucks (membership card), Syrup Pay, Shinhan Appcard, Kakao Pay, PAYCO, Hana Appcard, and Hyundai Appcard.

It turns out that online shopping malls are the ones that the services are used the most (71.9%, 1,609 respondents). Others are coffee franchises (7.5%, 168 respondents), department stores/wholesalers (6.6%, 148 respondents), convenience stores (4.6%, 103 respondents), restaurants/pubs (4.3%, 96 respondents), transport (3.7%, 83 respondents), and bakery (0.9%, 20 respondents).

The respondents answered that the simplicity of payment process is the most important feature of Easy Payment Services (40.7%, 911 respondents), as well as ‘the safety of payment verification methods (22.7%, 507 respondents),’ ‘users’ benefits such as discounts and special offers (20.2%, 452 respondents),‘ ’accessibility of affiliated stores (8.4%, 188 respondents)’. But the most uncomfortable feature of the service was ‘installation of apps’ and ‘use limited to affiliates,’ according to the study.

□ Consumers feel satisfied with the convenience, but not with additional benefits The study demonstrates that convenience of the payment process gave the highest satisfaction to consumers, scoring 3.69 points on average, while extra benefits are not quite satisfactory to them, obtaining 3.32 points.

In regard to convenience, Samsung Pay got the highest score (3.96 points), followed by Starbucks Korea (3.93), Hyundai Appcard (3.92), Shinhan Appcard (3.91). Regarding safety, Samsung Pay ranked the first with 3.76 points before Mobile Cashbee (3.68), Samsung Appcard (3.66), and Hyundai Appcard (3.64).

In terms of additional benefits, department stores and coffee franchises provide the most satisfactory service to consumers, led by L Pay with 3.69 points, followed by Tom N Toms Coffee (3.68), Mobile Cashbee (3.55), Holly’s Coffee (3.53), and Starbucks/Angel In Us (3.49).

Coffee franchises, credit card firms, and Samsung Pay seem to provide great accessibility to affiliates, with Starbucks Korea ranking the first with 3.83 points, followed by Samsung Appcard (3.66), Tom N Toms Coffee (3.65), Hyundai Appcard (3.64), and Samsung Pay (3.63).

□ ‘Errors in Payment’ is mostly complained About 9.5 percent of, or 212 respondents say that they experienced discontent or damage when using the service. The biggest factor for such inconvenience was errors during the payment process including dual payment and false charge (46.2%), followed by ‘cancellation or refusal on payment (43.9%),’ ‘leakage of personal information such as credit card information (22.2%).’

Based on the study, the KCA points out that there is room for improvement in simplicity, security, and generality to invigorate Easy Payment Services. The service providers should especially focus on integrating the procedures of checking affiliates and discount/point reserve with the payment process in a simpler and automatical manner, suggesting more options of payment verification methods apart from password, and giving information of affiliates to users when they join the services.

Furthermore, the agency is planning to ask for improvement to offices in charge to oblige notifications to consumers via SMS, phone call, and e-mail when errors occur during payment process, in order to reduce complaints and damage, and to have service providers from non financial institutions be subject to Electronic Financial Transaction Act, in order to prevent blind areas of liability created during the payment process.

[Tips for Consumers when choosing Easy Payment Services ]

- For efficient use of the service, consumers should set priority among simplicity, safety, and extra services of the Easy Payment Service. They may refer to the satisfaction scores suggested in the study. - For consumers who want many stores in which they can use the service, App Cards and Samsung Pay might be a good choice. These services can be utilized in most stores with card reader. But bosth of them mostly do not have extra benefits because the same benefits provided for actual credit card are offered to consumers. - For consumers who do not like to input credit card information for payment, pre-paid cards such as Mobile T-Money, Mobile Cashbee, SSG Pay, and coffee franchises’ cards can be useful. - For those who feel it cumbersome to download and install new apps for easy payment, Naver Pay, Kakao Pay, PAYALL, Smile Pay can be taken into consideration. These services do not require the inconvenience. - For those who buy goods at department stores, wholesalers, or coffee franchises, the services provided by those business could be useful in terms of extra benefits (i.e. point reserve, discounts). For more comfortable use of transport, Mobile T-Money, Mobile Cashbee, Samsung Pay, App Cards of credit card companies, and PAYCO are available.

|

|||||

| Next | Control Over Wet Wipes Needed | ||||

| Prev | Customer Satisfaction related to Overseas Purchase: iHerb’ as Overseas Online Mall, ‘New York Girls’ as Shipping Agent, ‘11st’ as Overseas Purchasing Agent | ||||